Morning,

If you’re anything like us, a parent texted you last night about the 60 Minutes feature on the CFPB. Nothing but respect for MY president, Leslie Stahl, who sure beat Elon this week as it pertains to Trump’s one real rule: don’t look stupid/weird/weak on TV.

The chaos continues, meanwhile, with some interesting twists and . . . dare we say bright spots? Read on for a wintry mix of bleak disappointment and pleasant surprises:

Monday in Brief for 2/24/2025:

Further federal firings/purges, now with preliminary judicial blessing: IRS, NIH, CFTC, HHS (including CDC), USDA, DOE, NPS, FDIC (and more!).

Plus: the White House is on the warpath against Humphrey’s Executor, the 1935 case wherein the Supreme Court upheld restrictions on the president’s discretion to fire appointed leaders at independent, expert agencies like the FTC.

Judge Chutkan denies blue-state AGs’ request for a temporary restraining order that would have blocked Musk/DOGE from accessing federal data and/or ousting employees.

The Trump NLRB has gotten to work, with Acting GC William Cowen issuing his first memorandum. Cowen’s memo rescinded certain Biden-era guidance docs, including ones that did the following:

Held that certain noncompete agreements violated the NLRA;

Held that “stay-or-pay” provisions (aka TRAPs) are illegal;

Questioned the impact of employee surveillance on the exercise of union organizing rights;

Supported the formation of unions for college athletes;

Limited employers’ use of confidentiality and non-disparagement terms in severance agreements;

Secured make-whole remedies for people facing unfair labor practices;

and more!

But the Deep State fights back! An NLRB administrative law judge just ordered Starbucks to bargain with its union.

From that (emphasis added):

“Starbucks Corp. was hit with its first bargaining order under the National Labor Relations Board’s landmark Cemex doctrine after an agency judge found it committed multiple legal violations in the lead-up to an election at a New York store.

The order handed out by NLRB Administrative Law Judge Jeffrey Gardner held that Starbucks managers unlawfully interrogated, threatened, and solicited grievances from workers at one of the company’s first locations to seek unionization.”

The Second Circuit upheld a verdict against Emigrant Mortgage company for violating the Equal Credit Opportunity Act by targeting Black and Latino communities with predatory loans (i.e., reverse redlining).

The Biden-era CFPB submitted an amicus brief in the case, which was brought by Relman Colfax.

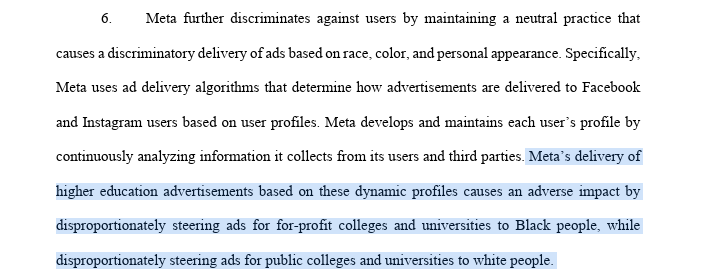

Speaking of redlining: the Equal Rights Center (repped folks including the Lawyers’ Committee for Civil Rights Under Law) accuses Meta of “engaging in modern-day digital redlining by providing separate and unequal services to Black users on its social media platforms Facebook and Instagram.”

From that (highlight added, of course):

Remember when these guys were bailed out during COVID?

Meanwhile, on the bad website, Hal Singer calls out Southwest for undertaking its first broad layoffs, and doing so outside of a business downturn.

NYT reports on a devastating but oh-so profitable private equity rollup in firetrucks that has raised prices and undercut safety. (hat tip to Basel Musharbash)

From that (emphasis added):

“For years, the fire truck industry had been ratcheting up prices on new rigs and failing to meet delivery dates of those that were ordered. Some departments have waited years for replacement vehicles while hunting the internet for parts to keep their older rigs going.

Those problems have compounded in recent years as Wall Street executives led an aggressive consolidation of the industry in a plan to boost profits from fire engine sales. One company, backed by a private equity firm, cut its own manufacturing lines as part of a streamlining strategy and then saw a backlog of fire engine orders soar into billions of dollars.”

BUT! FTC Chair Ferguson announces the agency will keep the Biden-era Merger Guidelines that drew the ire of the WSJ opinion pages.

Still, over at The Sling, U of Utah Law Professor Darren Bush warns us not to get too excited just yet about antitrust enforcement under Trump 2.0.

A coalition including Toward Justice, the Open Markets Institute, and various other consumer and worker groups is out with a new report raising flags and calling for action regarding corporate surveillance over workers and consumers.

Sign of the times: fintech payday lender Dave moves from accepting $0 “tips” as payment on its loans to “a simplified 5% fee structure including a $5 minimum and $15 cap”

Oh, the 2010s. The pants were tight, rates were zero, and the fintech at least pretended to be high-minded. Meanwhile: the Saudi BNPL company Tabby is about to IPO at a $3.3 billion valuation.

And finally: the Center for Responsible Lending is out with a pretty amazing report finding evidence that predatory vehicle-title loans are being made in at least 23 states where doing so is illegal. Regarding these loans, which can come with an APR over 300%, CRL found:

“Nearly two-thirds of borrowers (64.5%) were unable to make all their loan payments on time and reported paying late at least once. . . .

Among borrowers with at least one late payment, 40.7% reported incurring one or more of the following severe penalties as a result: car repossession, being sued for the debt, or wage garnishment. . . .

More than one in five (22.9%) of late-paying borrowers reported their car was repossessed due to late payments.”

Have a good week!